What is the corporate tax benefits?

After the company has operated until the end of its accounting period, it must submit financial statements and annual corporate income tax returns to the government. In general, the tax base of a business is calculated based on its taxable net profit. Therefore, tax adjustments and various benefits received from the government are at the heart of helping the company review its tax status to ensure that the information shown in the corporate income tax return is correct and consistent with the tax computation.

The various benefits that the government has given entrepreneurs have arisen for multiple purposes, such as stimulating the economy, helping alleviate the tax burden of entrepreneurs, or supporting the government's intention to collect taxes as fairly as possible. Therefore, the various benefits we would like to mention below are essential in helping you get the most advantage of tax savings.

Why should we recap the benefits in 2023?

For the company that started operating in 2023, if the accounting period is less than 12 months, the company is not required to submit a half-year corporate income tax return. However, the company must submit an annual corporate income tax return within 150 days from the last day of the accounting period, as specified in Section 69 of the Revenue Code of Thailand.

Even though a company that started operating before 2023 is familiar with the various benefits they can use, there are still a lot of benefits launching during the year. The company should also know how to apply them when filing the annual corporate income tax return.

What was happened in 2023

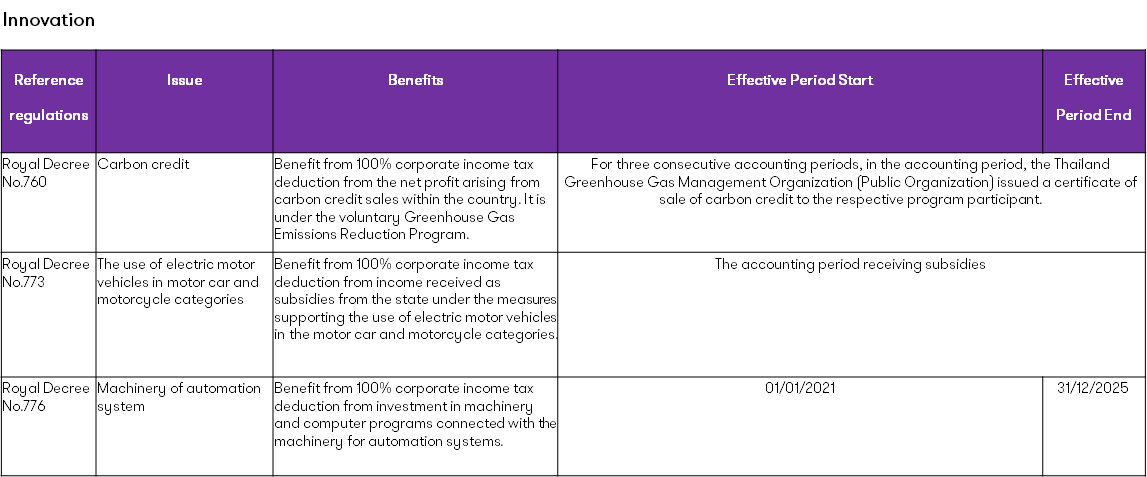

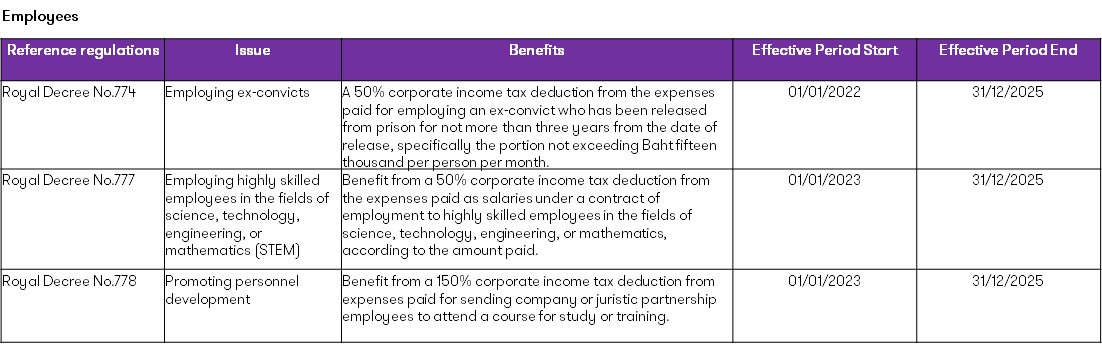

These are the available interesting tax benefits that were issued in 2023.

How are things going in 2024?

Regarding the table above, all benefits can be used for more than one accounting period, except for Royal Decree No. 773: The use of electric motor vehicles of motor car and motorcycle categories. Therefore, entrepreneurs or accountants of the company should stay up to date on the news from the government for the benefit of tax planning.

The trend of various benefits that may occur in 2024 may be related to the development of the Thai economy to grow sustainably and stably in the long term, as follows:

- Infrastructure Development: For example, developing sustainable energy, investing in digital technology and developing transportation that links different regions will help create new opportunities and make Thailand a regional hub.

- Skills Development: Preparing the workforce with the skills needed for the global economy is important and will promote long-term success.

- Fiscal Stability: Focus on prudent fiscal management, responsibly taking into account government spending and the level of public debt to maintain long-term financial sustainability. It will help Thailand cope with various risks and challenges in the future.

(Reference: Ministry of Finance news, issue 4/2024, dated January 27, 2024, subject: The prediction on Thai economy in 2023 and 2024 "Thai economy in 2024 is expected to grow at 1.8 percent per year and grow at 2.8 percent per year in 2024. It is necessary to closely update global geopolitical risk factors and the volatility of global monetary and financial market policies that may affect the Thai economy.")

For more details and information, please contact our expert.