At last – most offices have reopened, COVID travel restrictions are behind us, and an influx of tourists is helping to shake Thailand’s economy back to life. Yet the road to recovery is by no means free of obstacles. With trade tensions, rising energy costs, and the spectre of inflation hanging over the Thai and global business world, companies should make every effort to understand and prepare for the new environment we are currently entering.

To help businesses navigate through challenging macroeconomic conditions, we are providing a brief analysis of Thailand’s GDP, inflation, and interest rate forecasts from 2020 to 2025. Regional and global statistics will also be used for comparative purposes.

A note before proceeding: The future is always uncertain, and the only guarantee is that there will be surprises along the way. This article simply aims to extrapolate from current trajectories and provide corresponding guidance for businesses; the scenarios outlined here should not be taken as absolute and firm projections.

Growth

Thailand’s GDP Forecast

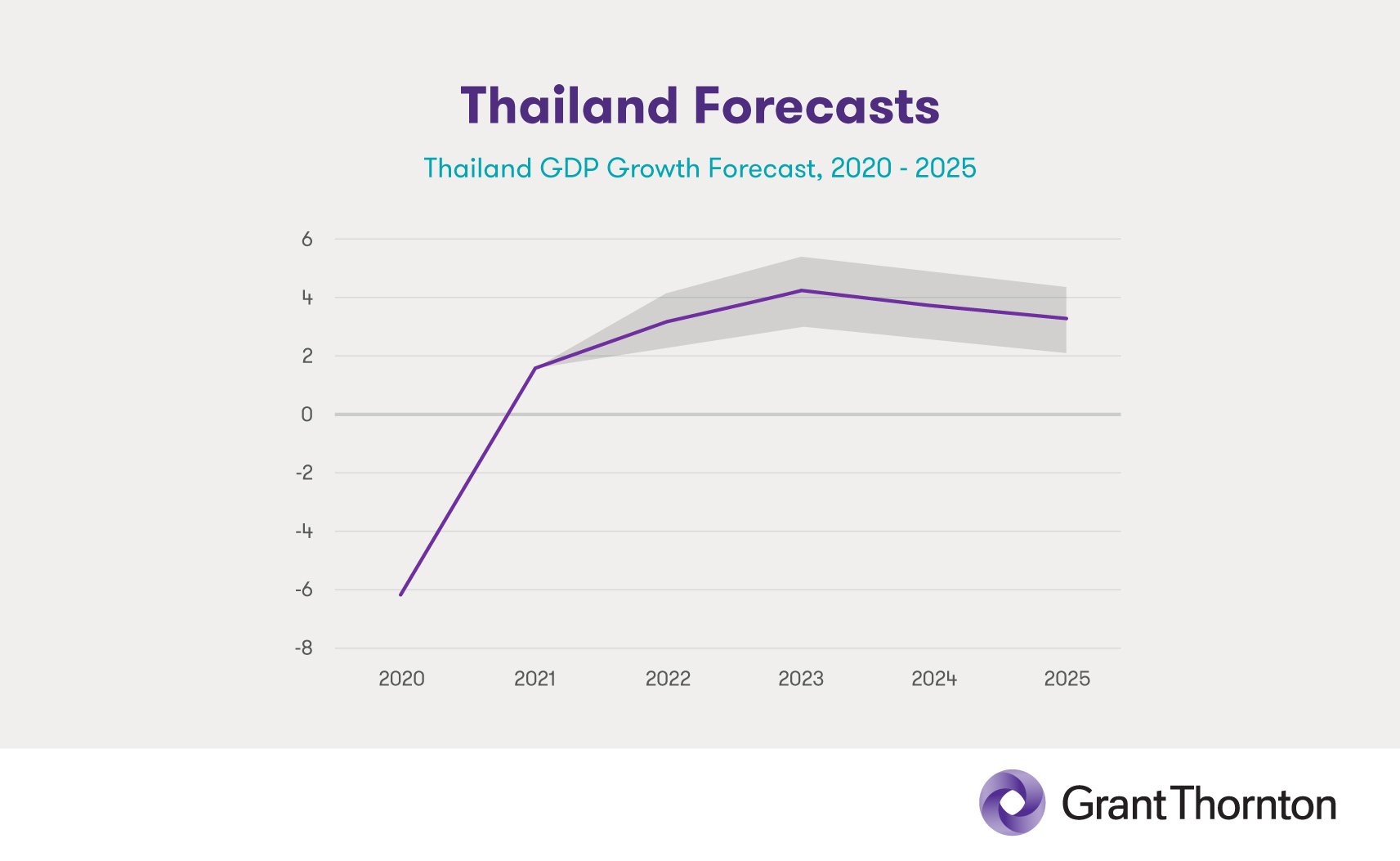

Thailand’s real GDP for 2022 is forecasted to grow by 3.1% – nearly double the rate observed over the first quarter of the year. This increase reflects strong economic fundamentals, paired with a rise in tourist numbers as the remaining travel restrictions are lifted. Moreover, as manufacturing continues to rebound, we expect the country’s overall GDP growth to reach 4% in 2023.

However, 2024 should bring a moderate weakening of this growth trend, settling into a roughly 3% annual rate from 2024 through 2025. The reasons are outlined below, and include the types of inflationary challenges that other countries will also have to contend with.

These numbers take into account Thailand’s emerging cannabis market and the proposed casino legislation, both of which could contribute meaningfully to the Thai economy moving forward. Each of these sectors represents a promising area of business development, and will be worth watching as Thailand’s post-COVID business environment begins to take shape.

ASEAN GDP Growth Forecast

GDP growth across ASEAN is likely to outperform the more mature Thai economy in the years ahead. Our forecasts include a continued regional recovery into 2023, peaking at around 6% before levelling out at 5% until 2025. The curve of this ASEAN graph resembles Thailand’s own likely GDP arc – and for similar reasons, as inflation threatens to reduce purchasing power across borders.

Noteworthy here is the region’s ability to continue growing in 2022 despite ongoing disruptions caused by the Russia/Ukraine conflict as well as China’s economic slowdown. Findings from our recent International Business Report (IBR) help to illuminate the source of ASEAN’s economic resilience, as relatively few mid-market companies identify finance shortages or the availability of skilled labour as constraints to their business health.

The same report, however, shows that 51% of the mid-market businesses in the region are concerned about rising energy costs – a variable to watch closely while assembling a plan of operations for the coming months and years.

Global GDP Growth Forecast

Based on our own international research as well as external sources, we expect global growth forecasts to hold steady after 2022, remaining at around 3.5% until 2025. Our IBR survey respondents indicated muted economic optimism, profitability, and private investments for the current 12-month period, setting the tone for the medium term. Moreover, we expect that global inflation will peak in 2022 or early 2023 before beginning to ease down over the coming years.

Variables to watch include trade tensions, rising energy costs, and fear of a global economic recession – any of which could further delay the economic recovery that businesses worldwide have been waiting for since the start of the pandemic.

Moreover, if inflation around the world is not brought under control quickly and some sense of normality returned to the markets, the chances of a significant global recession increase substantially.

Inflation

Thailand’s Inflation Forecast

Thailand’s exposure to inflation risks is expected to continue through 2025. Our analysis suggests that the core inflation rate (currently at over 3%) will peak at 5% in Q4 2022, followed by a steady drop over the coming years until it returns to around 3% or below by 2025. Headline inflation – which takes into account fresh food and energy prices, and is also referred to as CPI inflation – is already over 6%, primarily due to increased energy costs which most heavily impact the poorest in society.

In the current environment, inflation in Thailand is driven by external supply-side events – and is therefore best combated through several rounds of monetary tightening via the country’s Monetary Policy Committee, as discussed below.

ASEAN Inflation Forecast

Inflation will accompany regional GDP growth, likely peaking at around 3.5% in 2022 and declining slowly thereafter. As private consumption begins to pick up, we expect to see an increase in demand-side pressure which would prevent a quick reduction in inflation, prolonging its effects into 2025.

As with Thailand, the wave of inflation hitting ASEAN is caused by external events. For this reason, there is greater uncertainty as to when and how effectively these challenges will be resolved – hence our use of wider confidence ranges in the graphic above. At present, rising energy costs and other variables suggest that the upside inflationary risks are more likely than the prospect of rates subsiding earlier than expected.

Global Inflation Forecast

Having peaked in Q2 of 2022, global inflation will fall as a result of monetary tightening – just as it will in both Thailand and the ASEAN region. The overall shape of inflation graphs for the coming years generally resemble GDP forecasts, though they lag behind GDP projections by a few months. Overall, global inflation for 2022 is projected to be 7%.

We expect that developed economies like the US and the UK will experience inflation as a result of both demand and supply-side driven events. Minimum wages will likely increase as a result of rising energy costs, thereby preventing a quick recovery. From 2023 to 2025, gradual declines in inflation rates will lead to an eventual levelling off at around 4%.

Monetary Policy

Thailand’s Monetary Policy-Related Forecasts

To subdue inflation and return the economy to pre-pandemic levels, the Bank of Thailand will need to hike interest rates at regular intervals. Indeed, the BoT has already begun to pursue this strategy, raising rates from 0.5% to 0.75% in August, then to 1% in September. Rates could increase by another 25 basis points before year’s end.

Though necessary, these moves must be performed delicately in order to thread the needle of keeping inflation down while maintaining steady economic activity across the private sector. Should the value of the baht appreciate relative to other currencies, particularly the US dollar, the country’s exports could have trouble remaining competitive.

Turning the corner

We are in a period of great global instability and consequently businesses need to be ready to respond quickly to this ever-changing environment. Currently, the global markets are showing little or no confidence in terms of how governments will respond in the current climate, or whether officials are doing enough or the right thing. Recent events in the UK demonstrate how challenging the situation is.

Despite this, our economic view is that Thailand is in a stronger and better position than most to meet these challenges. These macroeconomic forecasts, alongside GT’s IBR survey, should give your business some general ideas about how to move forward.

Remember above all that leadership requires clear-headed decision-making, even when challenges are in view. If your company would benefit from strategic consultation or hands-on support, contact Grant Thornton in Thailand today.