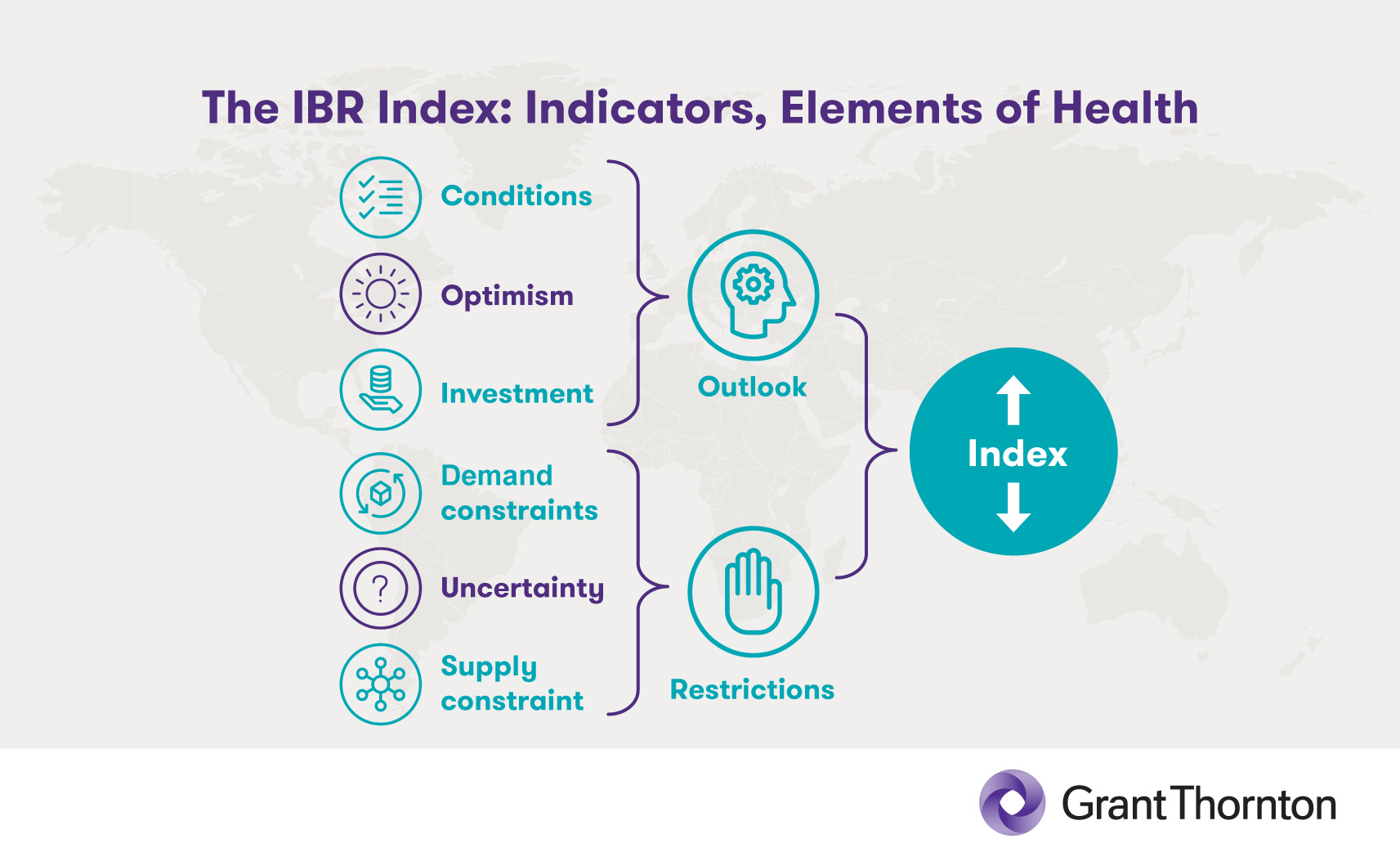

Grant Thornton in Thailand is proud to present the International Business Report (IBR) findings for H1 2022. This report features exclusive analysis from our survey of 10,000 mid-market businesses, as well as over 100 interviews with company leaders across sectors. In it, we review industry sentiment toward business opportunities as well as restrictions for the coming 12-month period. The IBR reflects current levels of business optimism, while also examining several macroeconomic factors that cause this optimism to increase or decrease across various regions.

The new report comes at a particularly important moment, as the economic shock of the pandemic begins to dissipate, and Thailand prepares to eliminate its last remaining COVID-era travel restrictions. At the same time, businesses throughout the region must prepare for possible supply shortages, rising energy costs, and inflation.

Global and Asia-Pacific findings

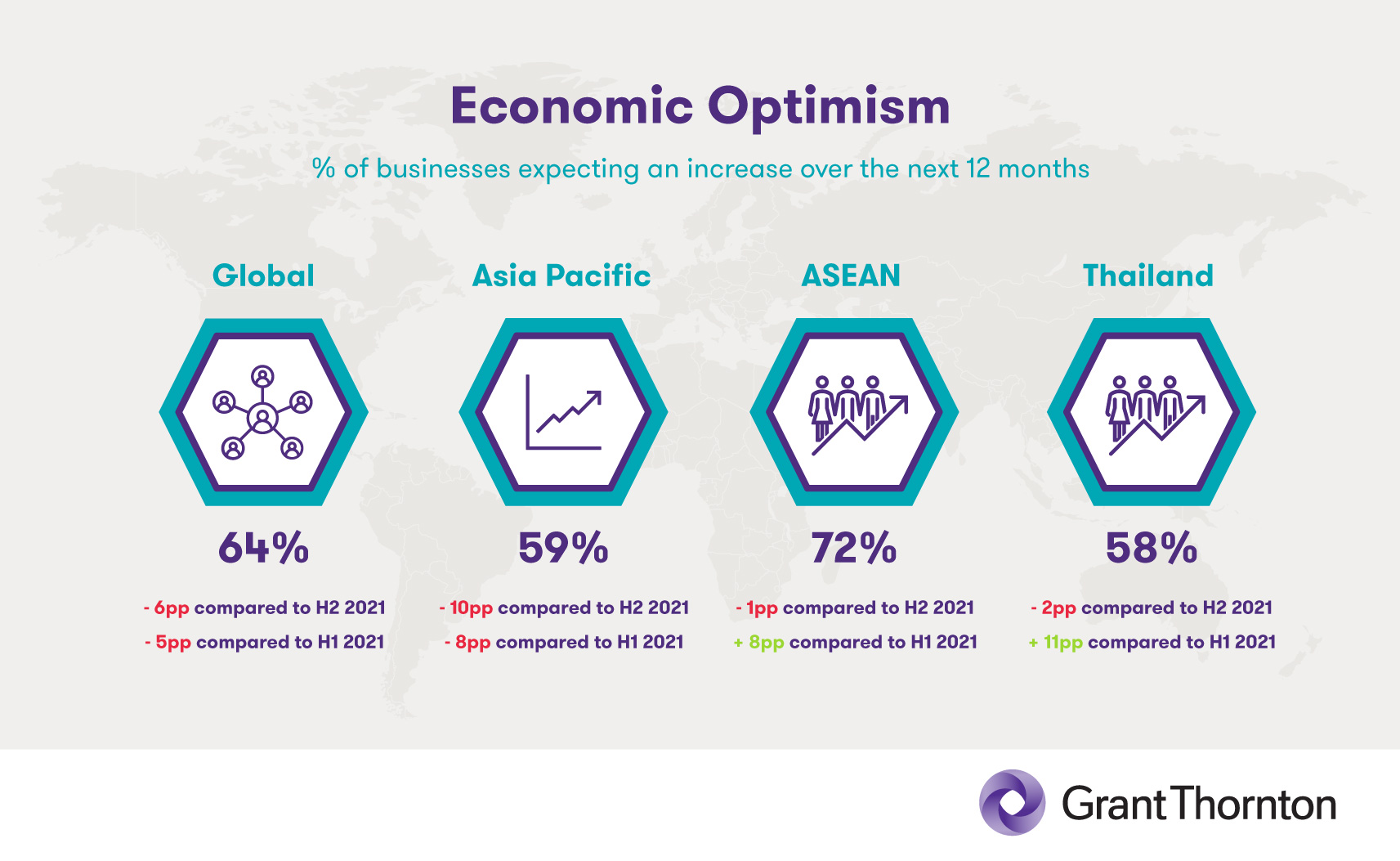

IBR survey results reveal a global business optimism score of 64%, a decline of 6 percentage points (pp) compared to H2 2021. The optimism score fell to just 59% across Asia-Pacific, a drop of 10pp over the same period. These modest totals reflect lingering business constraints that continue to delay the type of full-throated post-pandemic growth that many had hoped to see.

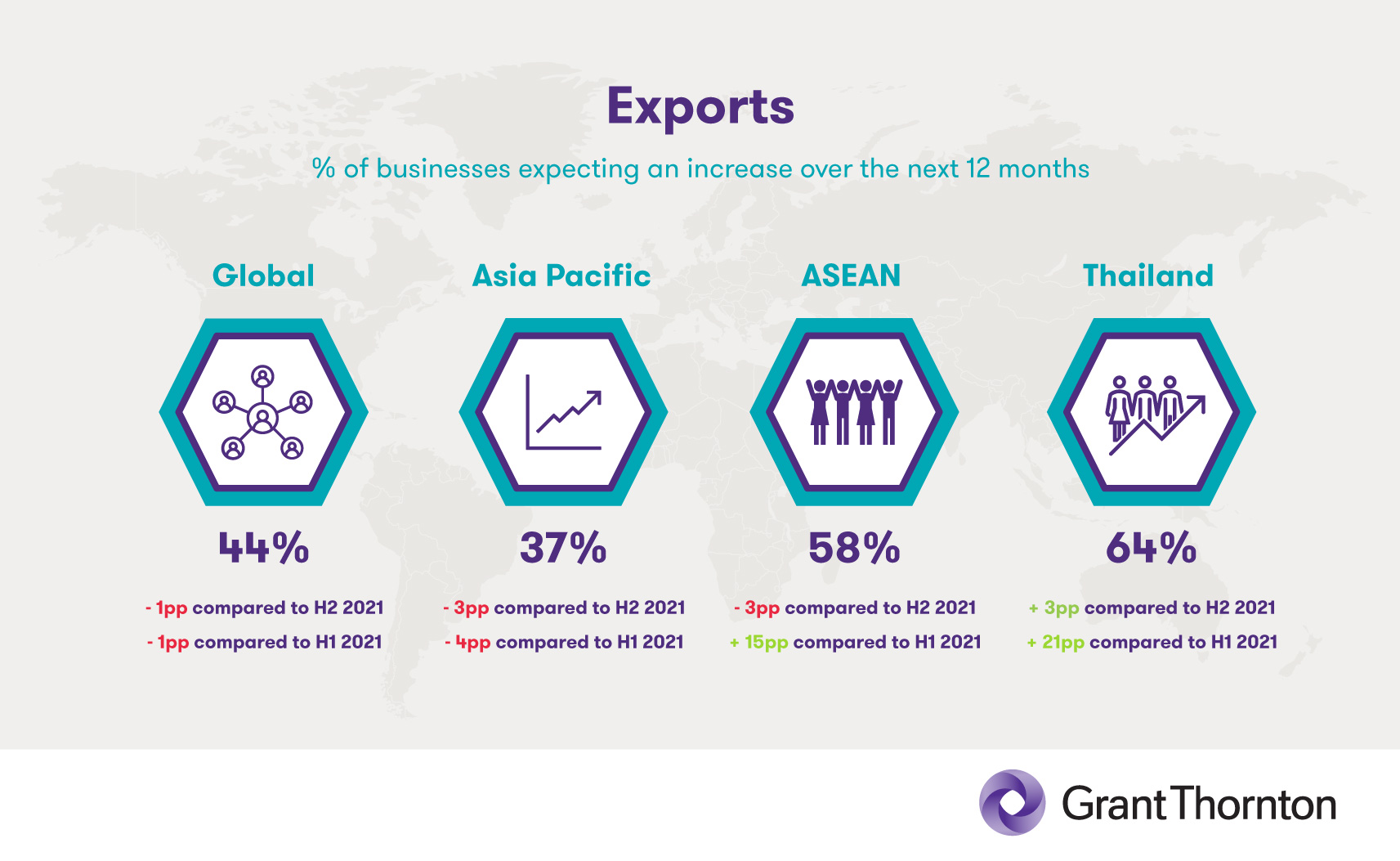

This reserved perspective is reflected in other indicators such as exports and profitability, which have also dropped modestly when compared with last year. Export sentiment worldwide for the coming 12 months is at 44% (a drop of 1pp from H2 2021), and at just 37% for Asia-Pacific (a drop of 3pp over the same period). In terms of profitability, global mid-market companies yielded a score of 54% (a drop of 3pp from H2 2021), while those in Asia-Pacific saw their total fall 1pp to 50%.

Key trends such as inflation, international trade tensions, and supply shortages are apparent contributors to the observed decline in global and regional business optimism. These and other situational factors can exacerbate business constraints, many of which are also measured by the IBR.*

* Reminder: When reviewing IBR survey results, keep in mind that business constraints are of negative value to companies. Higher percentages for these factors therefore reflect greater levels of concern, highlighting reasons for caution.

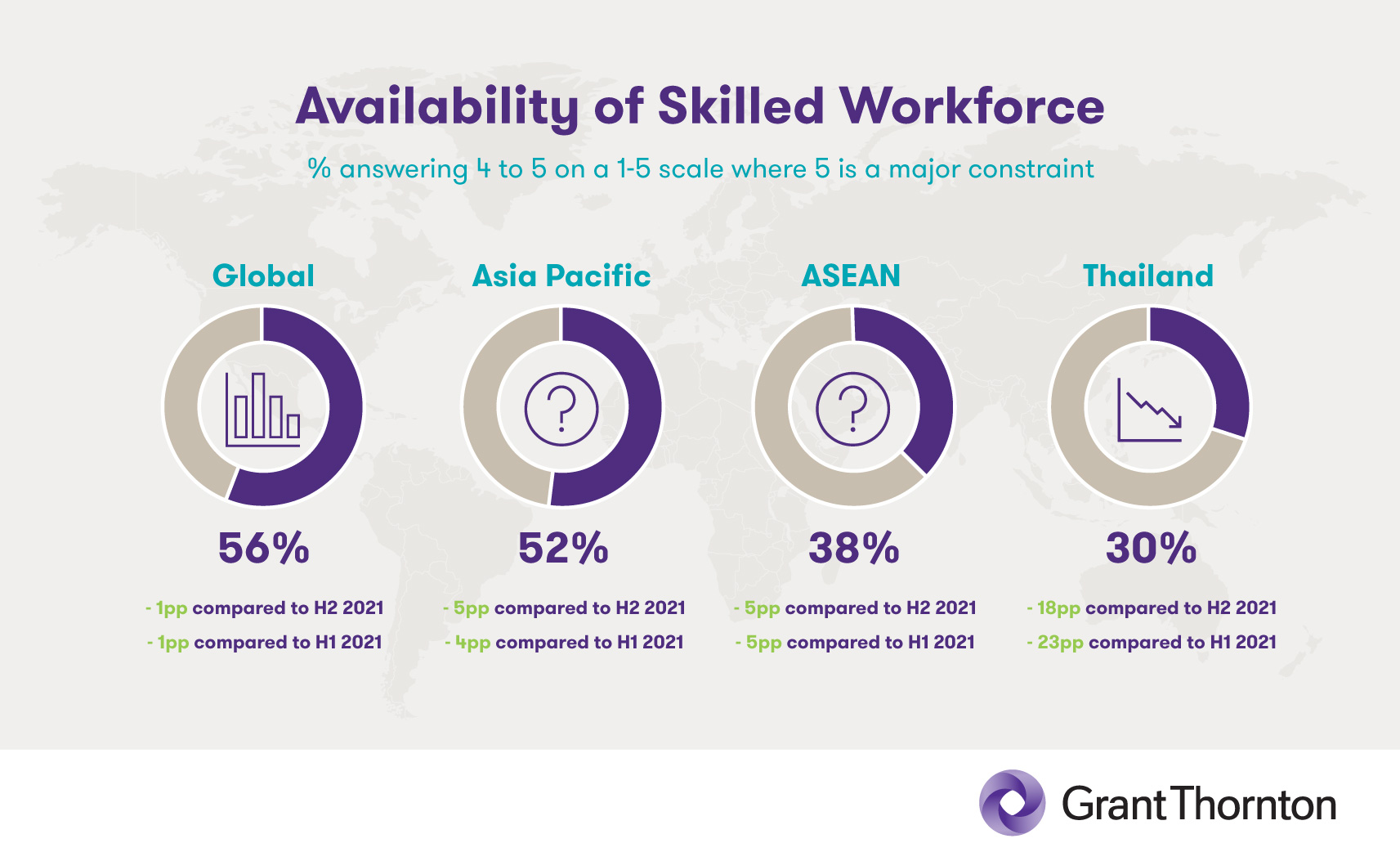

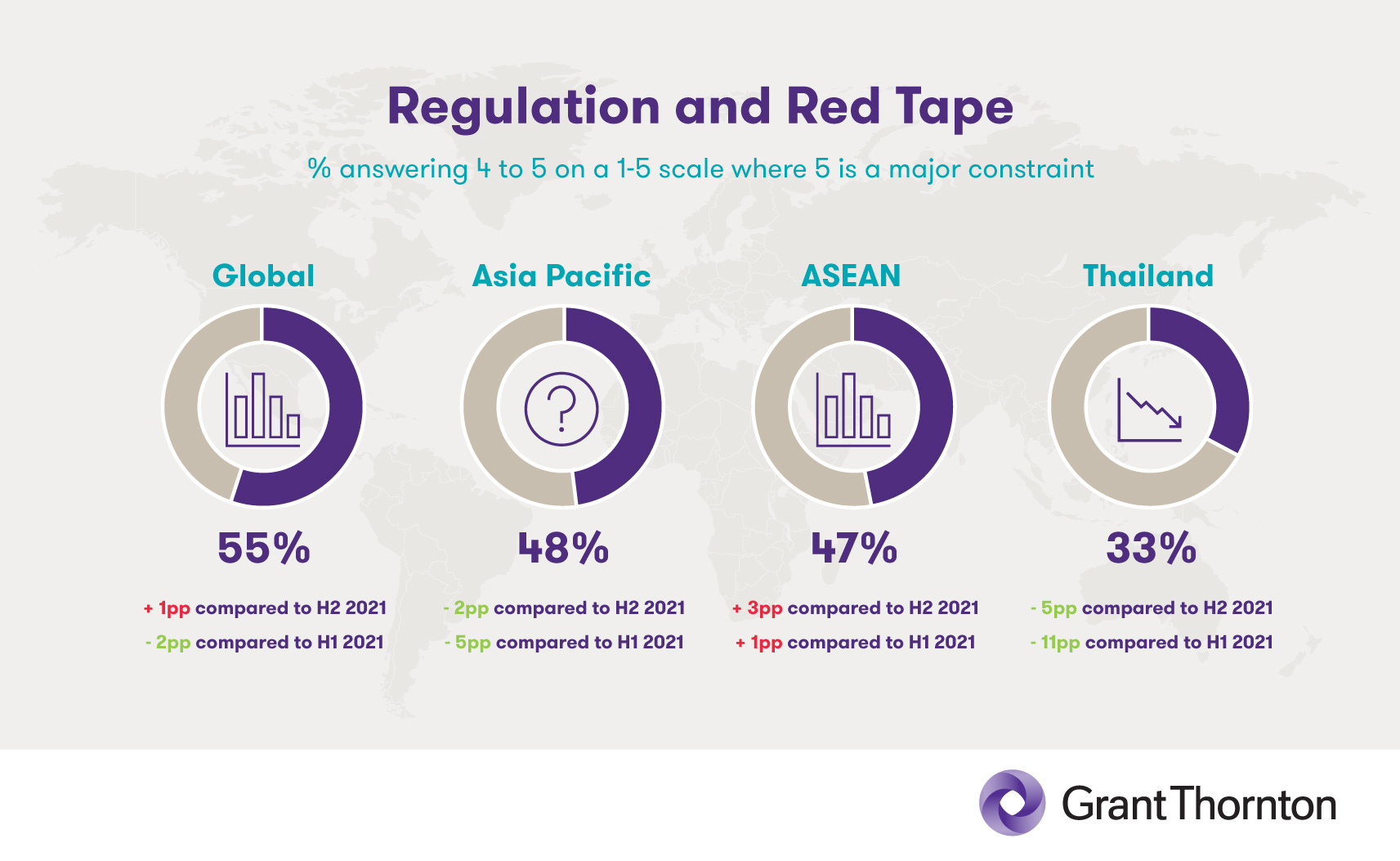

These constraints include continuing worries about a shortage of finance (50% among global businesses; 45 in Asia-Pacific), regulation and red tape (55% globally; 48% in A-P), and the availability of skilled workers (56% globally; 52% in A-P).

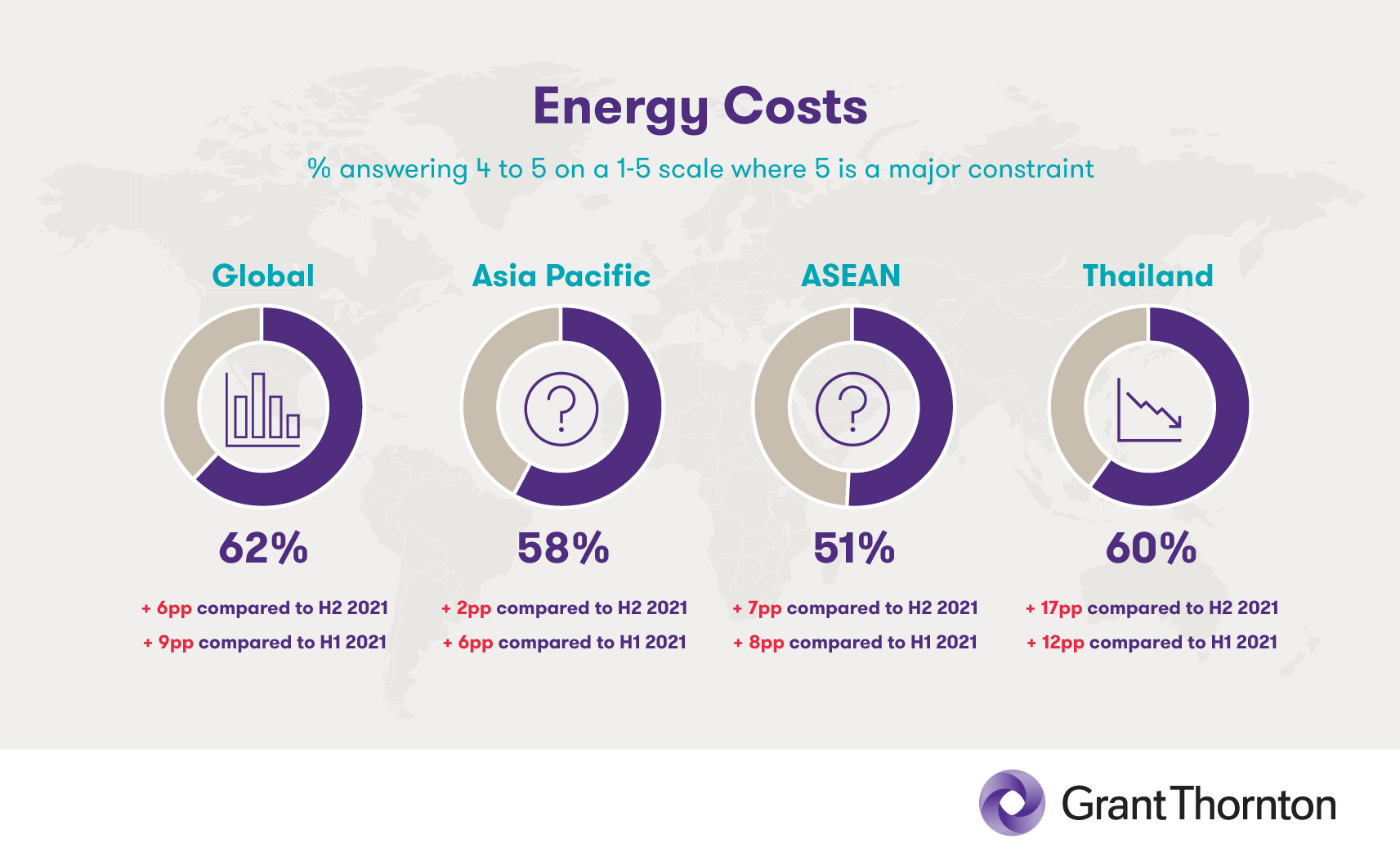

Rising energy costs are likewise beginning to affect company performance, as well as their outlook for the months ahead. Compared to the IBR totals from H2 2021, global business concerns regarding this business constraint have increased by 6pp, to 62%. Concern about this issue has risen 2pp over the same period in Asia-Pacific, for a current total of 58%. These numbers reflect significant levels of concern, and highlight a real challenge for energy-intensive industries.

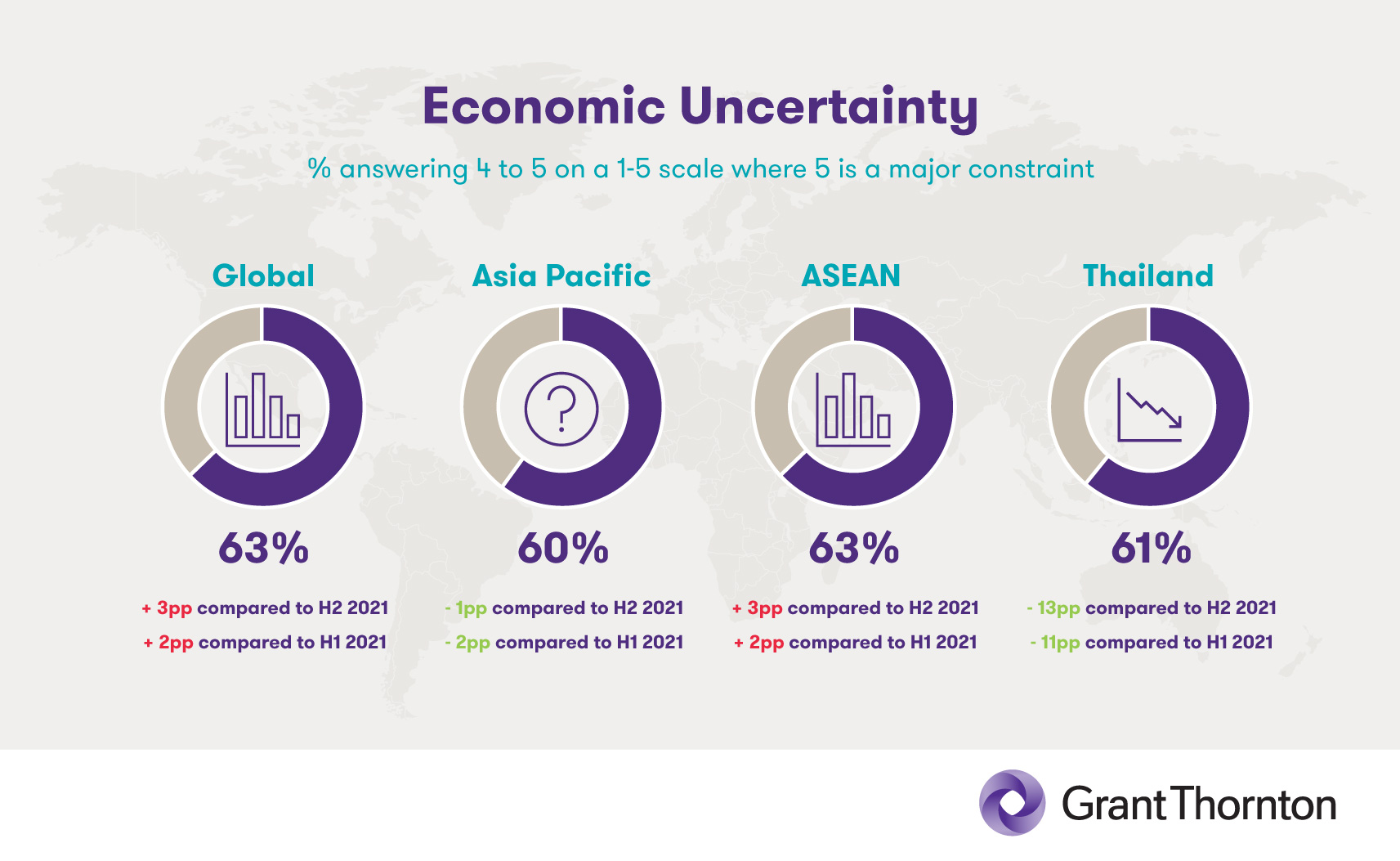

Overall, 63% of global businesses surveyed expressed economic uncertainty, with totals nearly as high (60%) within the Asia-Pacific region. Existing obstacles to growth are likely to result in a general economic slowdown affecting the rest of 2022, with medium-term global economic stability resulting in relatively constant growth across industries for the 2022-2025 period.

Although the relevant data is not included in the IBR report, our analysis of global forecasts suggests that inflation will peak in 2022, carry on into 2023, then fall gradually as a consequence of monetary tightening. The ‘inverted V-shape’ for inflation recovery may prove to be too optimistic, with prolonged rather than rapid improvement seemingly the more likely scenario.

ASEAN findings

ASEAN countries are showing rapidly increasing levels of economic optimism – with 72% of respondents indicating a sentiment of overall optimism moving forward, alongside a 8pp increase from H1 2021.

This high level of optimism dovetails with other analyses, such as the Asian Development Bank’s forecast of 5% GDP growth across Southeast Asia in 2022. Since much of the region still comprises developing countries, there remains plenty of room to grow, and the presumed end of pandemic-related slowdowns provides the opportunity for mid-market businesses to capitalise on that potential.

Looking closer, however, we find mixed indications regarding companies’ future investment intentions, as well as their evaluations of business constraints moving forward.

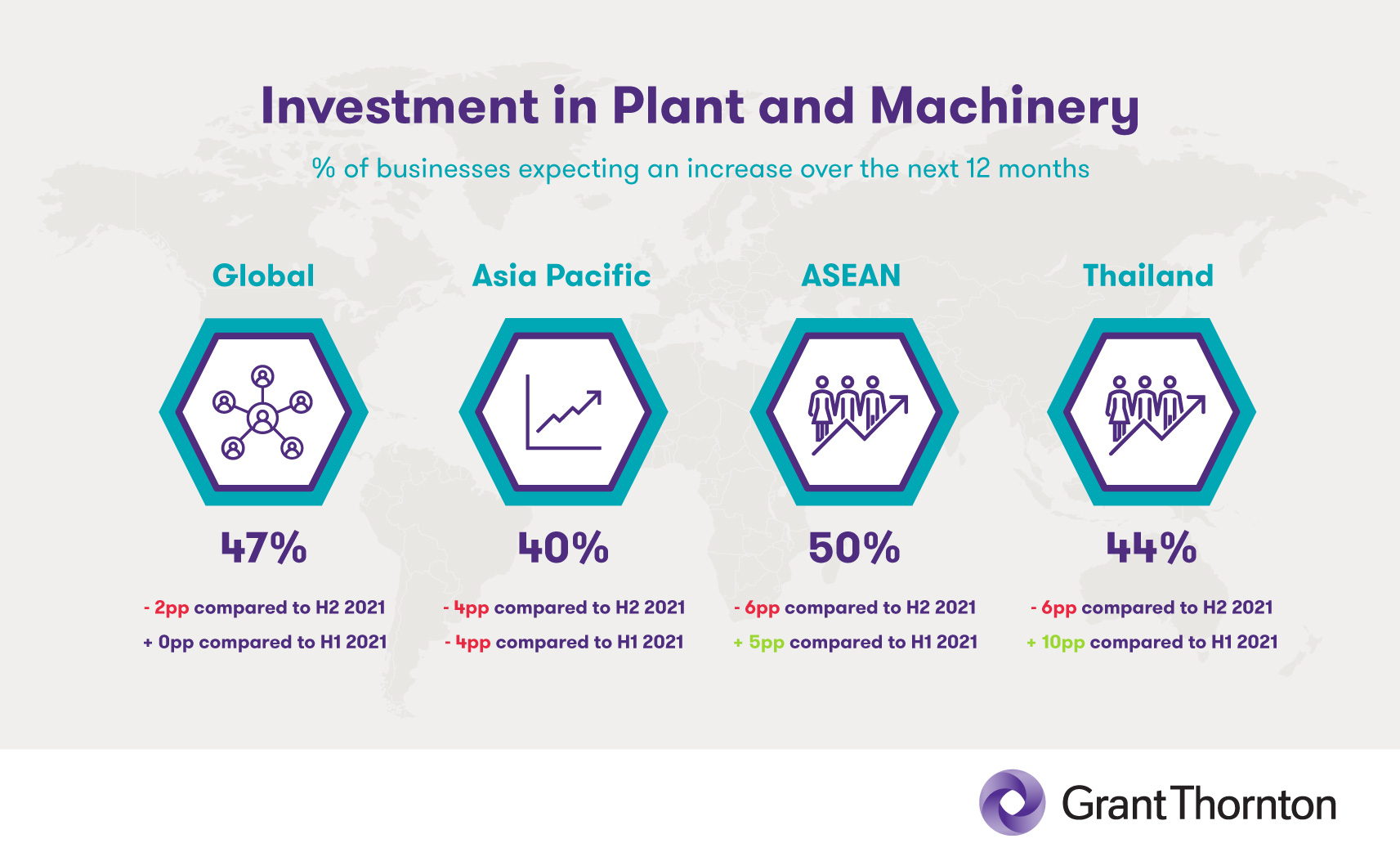

In terms of investment in plant and machinery, ASEAN’s current score of 50% represents a fall of 6pp from H2 2021. This decrease may be attributable to supply-side tension and cost-push inflation in the global economy.

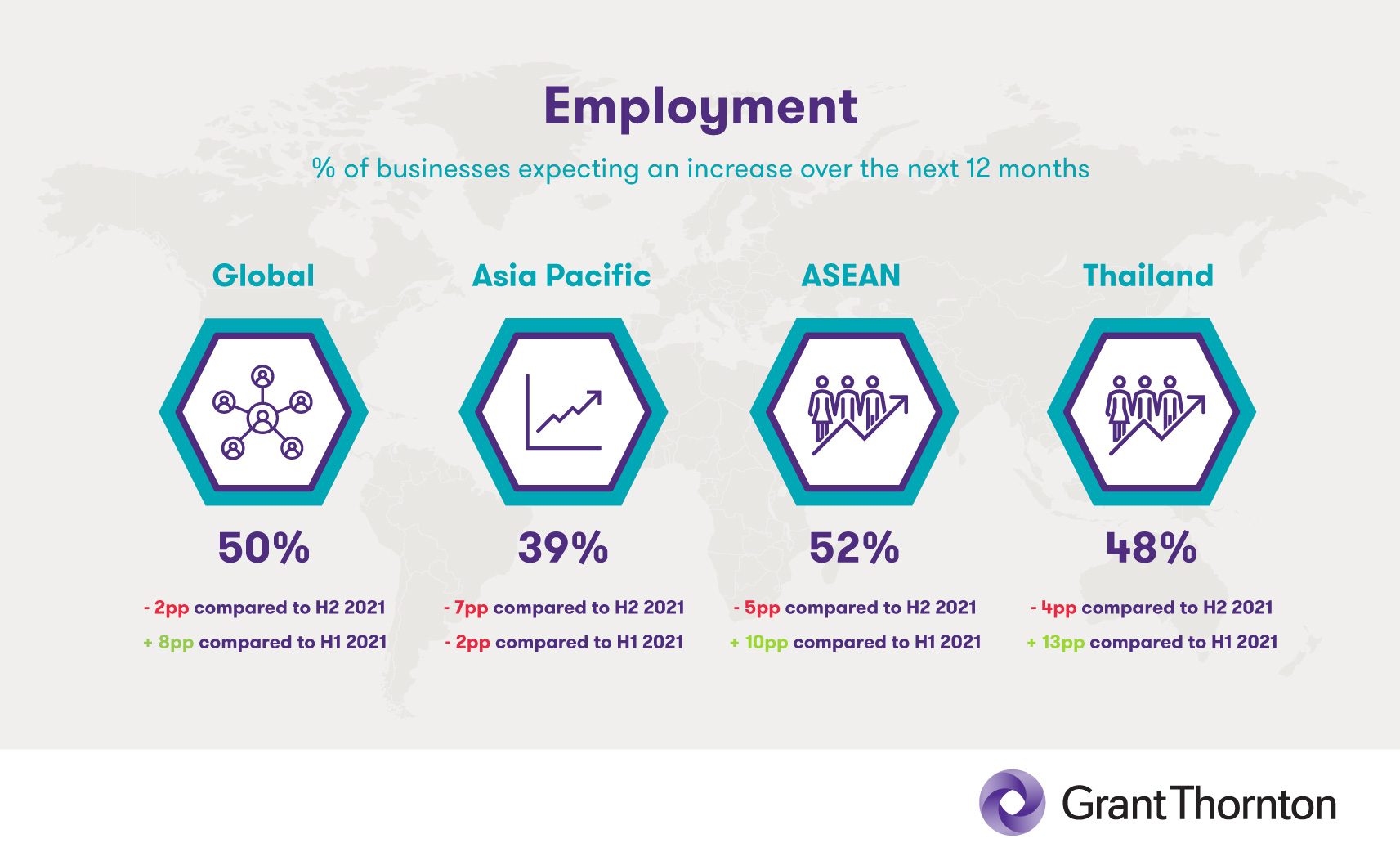

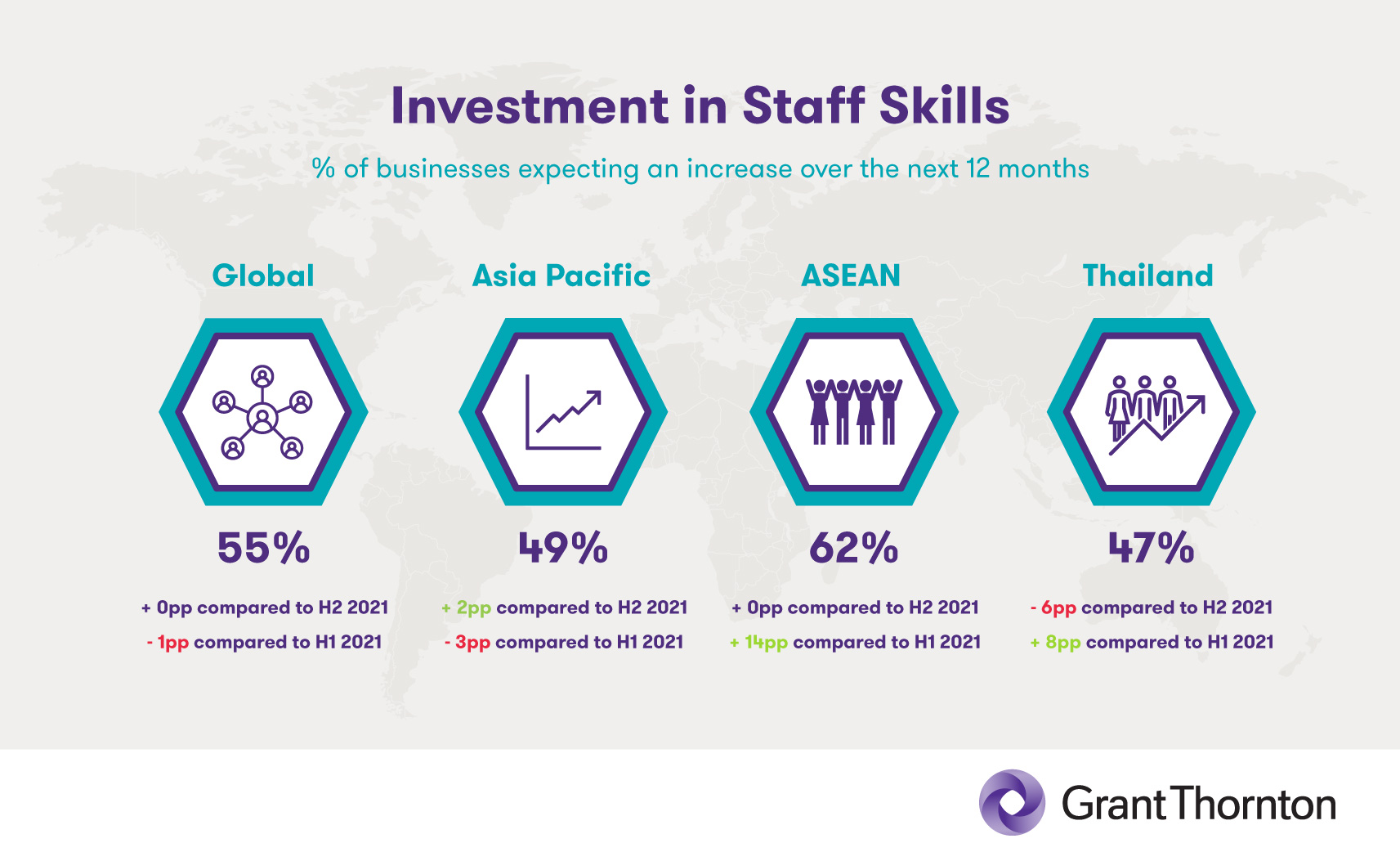

Optimism levels surrounding employment reveal similar trends, with ASEAN countries evidently feeling the pinch from the Great Resignation. Business sentiment on this topic currently stands at just 52% – a 5pp decline when compared to H2 2021. Respondents indicated greater levels of optimism (62%) on the question of investment in staff skills – a figure which is higher than the global, Asia-Pacific, and Thailand averages – though the current ASEAN score represents neither an increase nor a decrease from its own total in H2 2021.

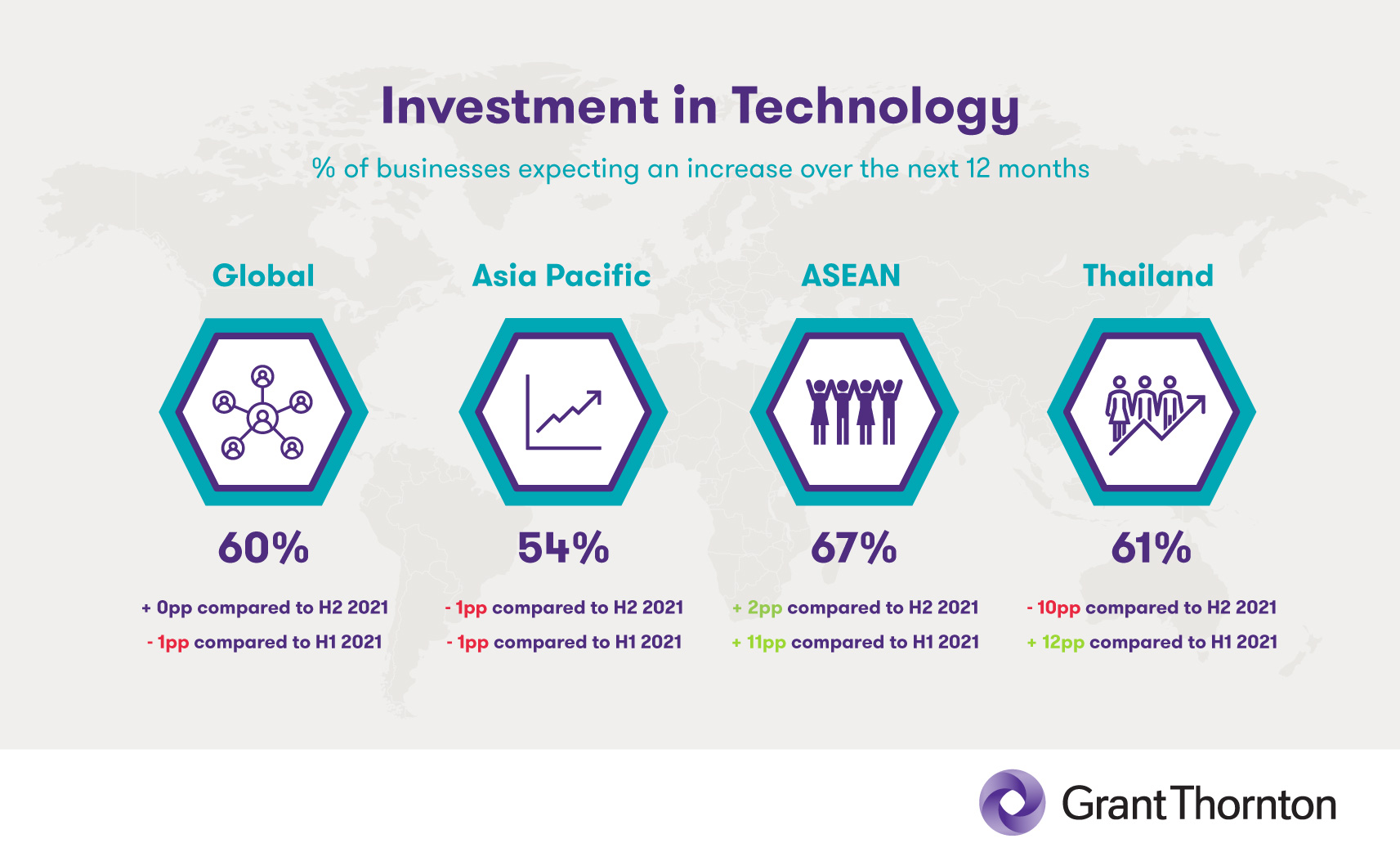

Even more encouraging numbers are reflected in mid-market sentiment surrounding investment in technology, where ASEAN’s score of 67% indicates an increase of 2pp, while also beating the global average of 60%. Indeed, ASEAN’s tech investment has continued to increase since the onset of the pandemic, and the region remains suitable for investment in technology – especially for tech startups.

Still, the constraints to business growth that are affecting the global business world are equally evident within ASEAN’s borders. These include the cost of energy, which now counts as a significant concern for 51% of the ASEAN business leaders we surveyed – fully 7pp higher than the region’s H2 2021 totals.

47% of ASEAN business leaders see regulations and red tape as a constraint to their businesses – a 3pp increase over the previous period, although this number may decrease in the coming months as most or all remaining pandemic-related travel restrictions are lifted. ASEAN already scores better on this metric than its global and Asia-Pacific counterparts – where 55% and 48% of business leaders express concern on this issue, respectively.

Prospects for future growth across ASEAN remain partly tied to inflation rates, which are expected to peak at around 3.5% as a result of monetary tightening. Other issues which are outside the region’s control could also play a large part in its fortunes for 2023 and beyond, including whether a stable, affordable supply of energy and materials will be accessible for import; and whether future COVID-related disruptions in China and elsewhere will affect the region’s foreign investment and export numbers.

Thailand findings

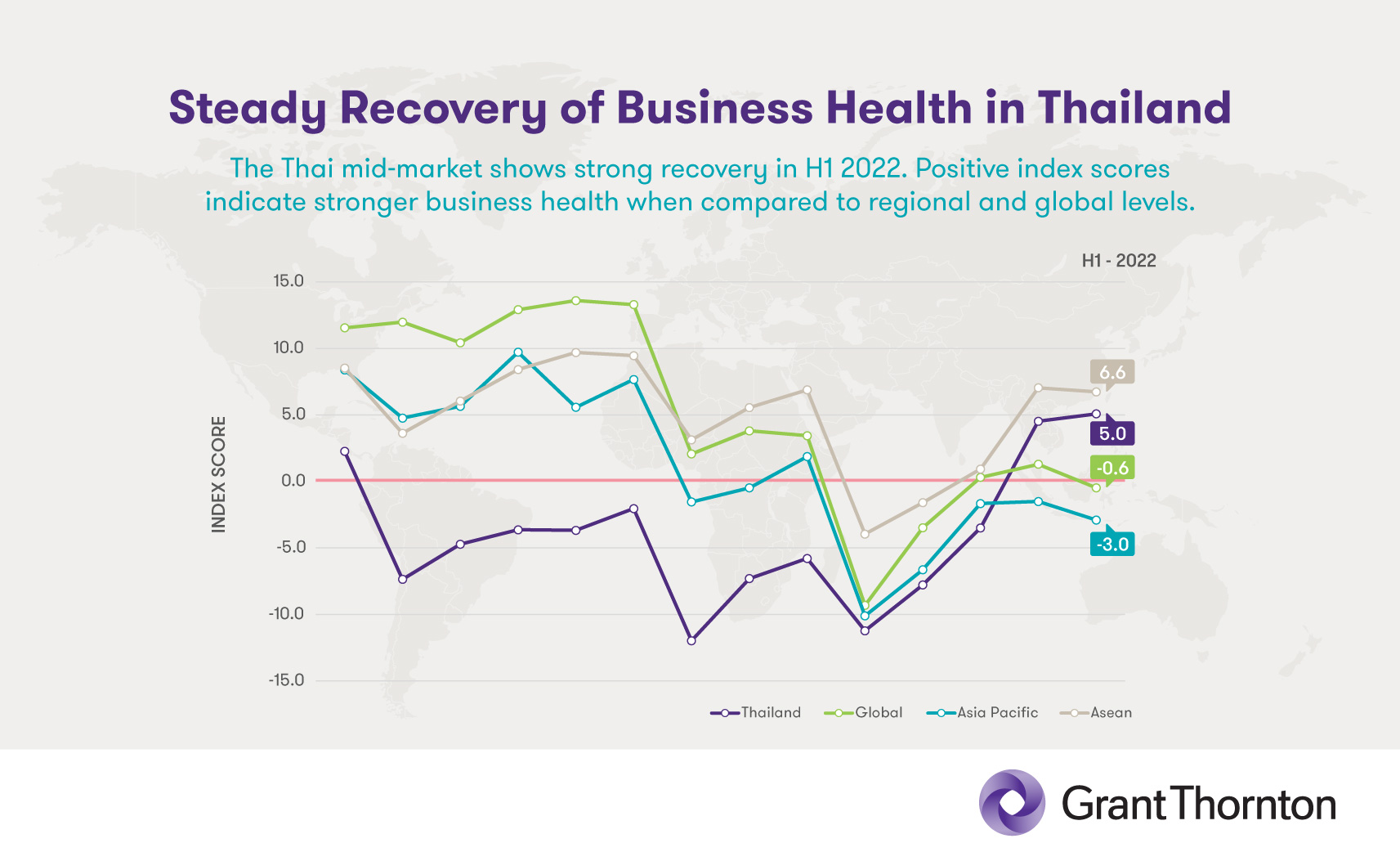

Overall business health across Thailand remains encouraging, and most indicators are likely to stay positive as the last of the country’s COVID-related travel restrictions are removed. This policy shift should remove all formal obstacles affecting the recovery of Thailand’s extensive tourism industry, though how long it takes to bring back pre-COVID visitor numbers remains to be seen.

The outlook for other industries in Thailand likewise involves optimism coloured by a degree of uncertainty. Business investment in technology, machinery, and skills training is fairly good, but still not at the level that many expected to see – raising the question of whether the Thai government is doing enough to encourage growth in these areas, as compared to the efforts being made in other countries and regions.

Despite enjoying a certain momentum toward recovery, as well as a competitive baht and solid export prospects, Thailand is experiencing lower economic optimism scores than the regional and global averages. The apparent discrepancy is resolved when we consider that Thailand has a relatively mature economy within its ASEAN grouping, and can therefore expect less rapid growth. The relevant numbers are highlighted in the graphic below:

Most of Thailand’s mid-market business community expects an increase in exports over the coming 12-month period, with an impressive IBR score of 64% on this metric. This figure is significantly higher than the global average, and also outperforms the ASEAN score of 58%. Notably, Thailand’s level of export optimism has increased since H2 2021, even as the regional and global averages declined. Remaining challenges include increased costs, global trade tensions, and supply shortages.

In terms of employment, Thailand’s businesses remain largely content with their current staffing levels, as just 48% of respondents indicated that they expect to increase their personnel numbers over the coming 12 months. Some sectors are currently reporting labour shortages although there has been an increase in foreign labour now coming back into the country. The country’s 4pp decline in this metric mirrors similar decreases at a regional and global level.

When reviewing the data below, it is also worth considering that the recent COVID outbreak, which peaked in April, could be skewing the numbers somewhat. Thai labour laws could also be playing a role here, as they force many companies to keep people on staff even when they are no longer needed. Companies in other countries are permitted to lay off workers more easily, either to save money or to replace them with younger employees whose modern skillsets enable greater productivity. As many companies in Thailand already have a residual workforce, further increases become less likely.

Closely related to the issue of employment is companies’ expected investment in staff skills, and Thailand’s businesses likewise show reduced optimism for growth in this area. A decline of 6pp since H2 2021 puts Thailand on markedly lower footing than its ASEAN and global counterparts, though its numbers and prospects may rise once again if the government modernises its labour laws to better fit the tech-powered economy that it seeks to promote.

Although Thailand’s optimism levels surrounding technology investment remain in line with regional and global averages, its score dropped by a full 10pp when compared to H2 2021. As the data indicates, similar declines were recorded in the country’s scores for investment in staff skills, as well as investment in plant and machinery.

These weaker numbers may be less a reflection of business fundamentals than business confidence, suggesting that the Thai government could do more to show its commitment to supporting business growth during this extended recovery period.

As noted above, businesses in Thailand remain reluctant to invest in plants and machinery at the present time. IBR surveys showed a decrease of 6pp on this issue when compared to H2 2021 – a fall which is on par with similar declines both regionally and globally. This and related IBR findings reflect a general decline in investment and human capital, indicating that businesses in Thailand are not yet ready to bet on a stable period of growth.

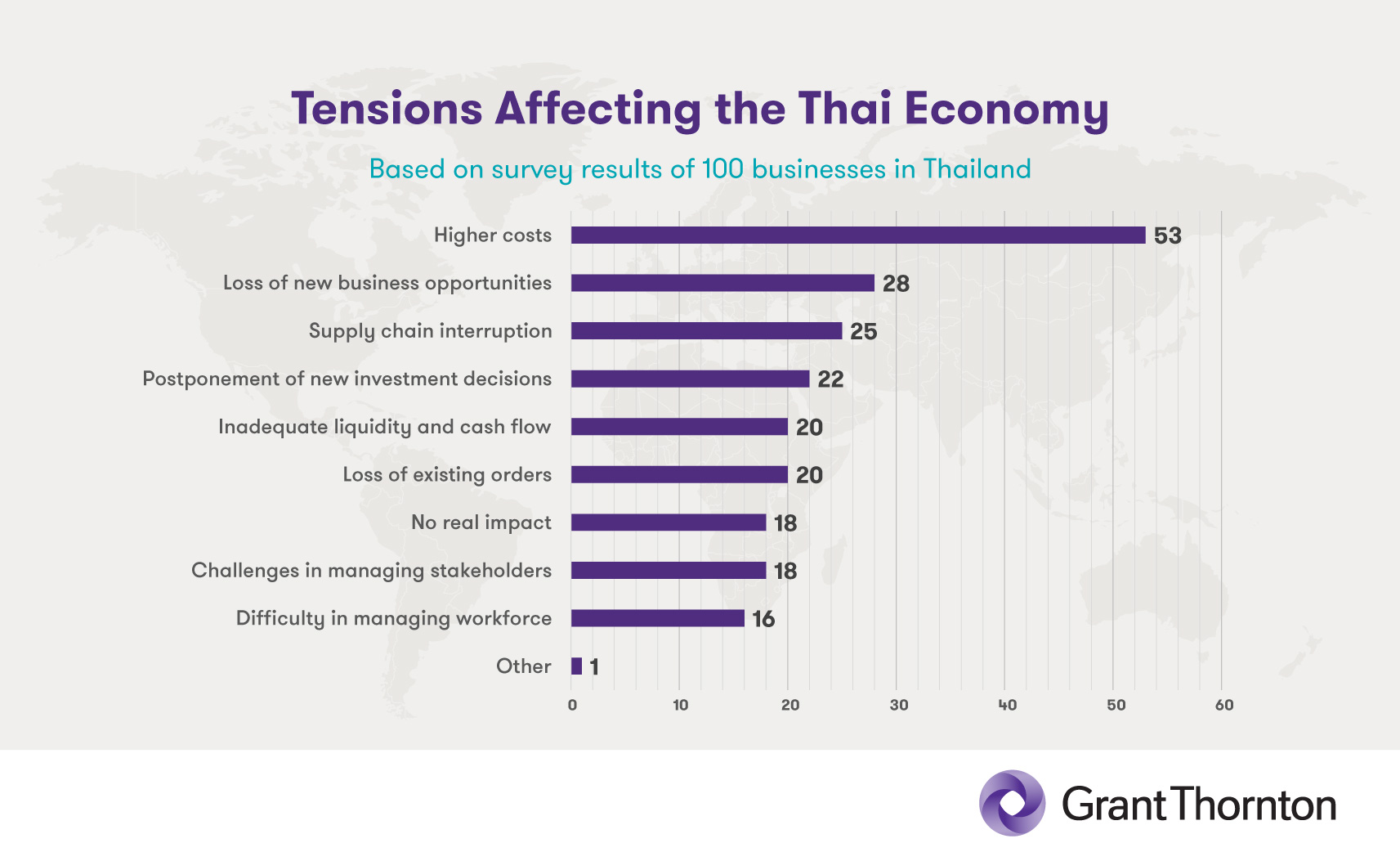

Significant constraints to business growth are listed below, and include challenges situated both inside and outside of Thailand. Each of them nevertheless contributes to the metric of general economic uncertainty, a measurement which has dramatically decreased in Thailand since H2 2021. This 13pp drop in economic uncertainty brings Thailand down to 61%, still high although fully in line with regional and worldwide averages.

Improved tourism figures, alongside rises in both imports and exports, have contributed to this fall in uncertainty – but as we examine below, significant issues remain.

One of the key issues to watch is the cost of energy, which has increased more in Thailand than in most neighbouring countries. Thai people and businesses are already facing pricier electricity bills, a constraint whose impact is evident in the country’s steeply rising IBR score. 60% of respondents within Thailand’s business community expressed significant concern over rising energy costs – a 17pp rise over the previous period.

By contrast, Thailand finds itself in remarkably good shape regarding the availability of skilled workforce. As one of the higher performing countries in this category, Thailand scored just 30% on this metric, recording the highest improvement (18pp) of any country in the region. Worth noting, of course, are the concerns expressed by many that Thailand’s education system lags behind others when it comes to producing graduates whose skills are suited to an advanced digital economy. Yet for the time being, most businesses seem satisfied with the quality of the country’s talent pool.

Another business constraint that Thailand’s businesses consider to be fading into the background relates to regulation and red tape. Thanks in large part to the easing of travel restrictions and export-related laws, Thailand is the only country worldwide to improve by 5pp since H2 2021, while scores for most of its ASEAN counterparts worsened slightly. The Thai business community’s score on this metric is just 33%, indicating that a two-thirds majority see regulation and red tape as less than a major issue. Although Thailand is ordinarily a risk-averse nation, a majority of survey respondents (56%) also support removing all COVID-19 restrictions now.

Although the numbers above tell a detailed and complex story, certain variables within the economic landscape can serve as guideposts to create a more intuitive understanding of the situation.

From a business perspective, the first half of 2022 was largely shaped by higher costs in a number of areas. Supply restrictions caused by geopolitical events as well as by lockdowns in China led to availability bottlenecks for certain materials, while the rise in inflation has caused more general and widespread slowdowns. Whether the future brings continued disruptions of these (or other) types, or a return to normalcy, will have a significant bearing on the Thai business community.

Moving forward, we expect interest rates in Thailand to reach new heights as part of a hawkish monetary policy. The aim of this measure would be to reduce the country’s money supply as a way of combating inflation. If such a policy is indeed implemented, its knock-on effects will be felt far and wide – and the question of whether it produces the desired impact will be an important one.

Bearing these uncertainties in mind, it is worth considering that the World Bank anticipates a 3.1% GDP growth rate for Thailand in 2022. That estimate is in line with recent pronouncements made by the Bank of Thailand, which in turn expects the country’s 2023 GDP to rise by 4.1%.

This type of growth calculation, alongside the removal of COVID-related travel restrictions and the arrival of increasing numbers of tourists, is helping to fuel optimism within the business community. Understandably, however, many wish to see concrete and sustained recovery numbers before presuming that Thailand has indeed entered a new era of growth.

It is also worth observing that while some constraints are unlikely to cause major disruption in the near future, they nevertheless loom large on the long-term horizon. As we have explored in a previous article, Thailand joins a number of other countries whose declining birth rates and improved healthcare systems are giving rise to an ageing population. As this trend begins to warp the traditional demographic pyramid, overall productivity is certain to decrease as social expenses rise, leading to new types of economic challenges.

Preparing for the road ahead

In automobile racing, the winner is not necessarily the driver whose car can go fastest on a straight road. More valuable is the ability to turn corners skilfully and with the right timing, as these are the ideal moments to gain ground on one’s competitors.

The world of business operates on similar principles, particularly during periods when changing technologies, operating models, and environmental factors are the norm. The biannual Grant Thornton International Business Report leverages the combined observations and predictions of mid-market company leaders to provide a rough user’s guide to the potential twists and turns in tomorrow’s business landscape.

The IBR’s main findings – including declining levels of optimism worldwide, in the Asia-Pacific region, across ASEAN, and within Thailand – mostly reflect challenges whose origins are outside the control of the businesses they affect. Inflation is likely to remain a significant growth constraint through 2022, holding relatively steady during most of 2023, and then easing slowly throughout the 2024-2025 period. Material supply disruptions may continue if the Russia-Ukraine war escalates further, or if China/US relationships deteriorate (including increased tensions over Taiwan), or if new waves of the pandemic prompt the re-establishment of business or travel restrictions.

On its present trajectory, Thailand is expected to show modest recovery during the months ahead. Even so, the general uncertainty of the global economy suggests that company leaders should navigate the post-pandemic world with caution, proactively anticipating likely business constraints and taking effective measures to work around them.

Grant Thornton in Thailand helps businesses across industries identify their opportunities as well as their vulnerabilities, supporting them with practical guidance and expertise as they turn each corner on the road to sustainable growth. Contact us today to get started.

A note on methodology: Since 1992, the Grant Thornton International Business Report has regularly generated detailed economic insights by surveying around 10,000 businesses across 29 economies. We use refined questionnaires translated into local languages, as well as online and telephone interviews for our biannual reports. Our IBR H1 2022 report reflects data gathered in May and June 2022, from mid-market CEOs, Managing Directors, and other senior executives from all sectors. We are grateful to Oxford Economics for supporting these efforts through additional research and analysis.